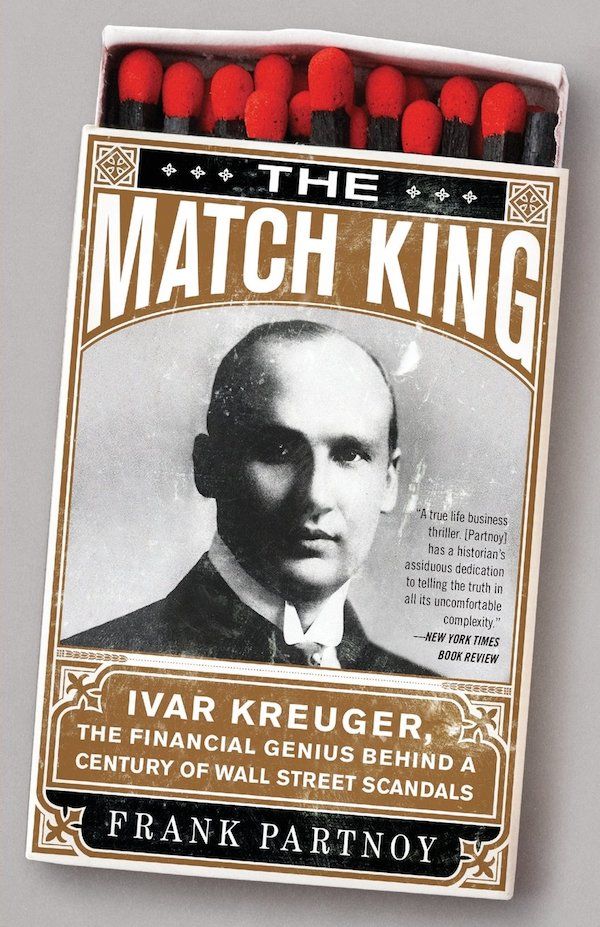

The Match King: Ivar Kreuger, The Financial Genius Behind a Century of Wall Street Scandals

Partnoy helps us untangle Kreuger's intricate international web of hidden bank accounts, secret deals, bond issues, and government monopolies to understand how Kreuger pulled off one of the greatest swindles in history.

"The Match King" was a perfect fit for my year of "Crime and Punishment" because it combined corruption and murder with two of my favorite topics: entrepreneurship and Sweden! Although we don't hear much about him now, Ivar Kreuger rivaled Jack Morgan in the 1920's as one of the captains of international finance. But unlike Morgan, Kreuger turned out to be running quite a scam on top of all of his legitimate business - sort of a 1920's Bernie Madoff. Yale Law grad Frank Partnoy helps us untangle Kreuger's intricate international web of hidden bank accounts, secret deals, bond issues, and government monopolies to understand how Kreuger pulled off one of the greatest swindles in history. Partnoy paints his cast of characters with vibrant detail and shows us how Kreuger expertly controlled his public image (and his auditors!) to dupe America's financial class. This was a guy who was a trusted advisor to President Hoover, a trans-Atlantic cultural icon, and owner of a brain that always seemed two steps ahead. I was almost surprised that he wasn't involved in the Teapot Dome scandal that occurred at about the same time! And to top it all off, his mysterious death in 1932 still has investigators scratching their heads.

Yet Partnoy shows us that Kreuger's legacy is not quite so black and white. He left an enormous physical and cultural imprint on Sweden: constructing the stadium for the 1912 Stockholm Olympics, founding Svenska Filmindustri, promoting (and dating) a young Greta Garbo, and building Stockholm City Hall (where the Nobel Prize is awarded). Although notorious for his innovations like off-balance-sheet financing, Kreuger did create legitimate financial mechanisms (like B shares) that are still in use today. And as Partnoy explains, Kreuger's fraud was the major impetus behind the Securities Act of 1933 which GAAP and other modern financial rules. And to be fair, Swedish Match actually still exists and employs over 12,000 people!

Ivar Kreuger's story has been overshadowed by the two World Wars that bookend it, but his fascinating life set the stage for much of 20th century financial history. Partnoy's retelling is well worth a read.

PREFACE

“Everything in life is founded on confidence” -Ivar Kreuger

The congressional investigation into his companies led to the securities laws that govern today’s markets.

The best investors - today and yesterday - make money not because they understand abstruse mathematical models, but because they have a deep intuition about the timing and machinations of financial markets. Markets have been complex for a long time, and their ebbs and flows always have depended, not only on intricate disclosures about assets and liabilities, but also on human psychology. That has not changed since the 1920s.

He was, in many ways, the original Bernie Madoff.

Yet memories of this man have faded, even more than the blue telex printing on the thousands of cables he sent from luxury liners and five-star hotels as he moved among offices in New York and throughout Europe. Many of those telegrams, along with decades of personal letters and financial statements, have sat virtually unexamined for years in a castle in Vadstena, Sweden.

1 - COMING TO AMERICA

What the passengers aboard Berengaria did not know was that Ivar spent hours every day just preparing to talk. When Ivar knew he would be meeting a new group of people, he planned the first impression he hoped to make in advance: whom to meet first, which nuggets of information to drop, and where to move next.

Ivar was sailing to America for one simple reason: that’s where the money was. After a brief recession, a post-war boom had ignited the Roaring Twenties, and by 1922 the country was awash in cash.

The hottest two emerging industries were cars and radio.

RCA enjoyed a wireless communications monopoly, thanks to Navy Secretary Franklin D. Roosevelt, who had engineered a “marriage of convenience” among the government, General Electric, and Westinghouse, which manufactured wireless devices.

A German chemist had invented phosphorous matches in 1832, but the German matches had been too dangerous, both because the yellow phosphorous necessary to light the match was poisonous, and because the Germans had put the phosphorous in the match head, which was prone to light accidentally. The Swedes took the German invention and captured the market by emphasizing safety, simplicity, and innovation. First, the Swedes developed a safer red phosphorous. Then they moved the phosphorous to a striking surface on the match box. Boxes were labeled “safety matches” and were printed with the slogan “Will Only Light on the Box.” They were an instant hit. By 1922, Sweden was the leading exporter of matches, and Swedish Match Corporation made two-thirds of all matches used in the world. Matches were Sweden’s pride, and its most important export.

Antitrust regulators had declared monopolies illegal at home, but, by investing in Swedish Match, Americans could earn profits from a monopoly abroad.

As a child, he had watched his father, Ernst August, a fifth generation Swede, work in the small factory their ancestors had built near Kalmar, a city in the southeast, overlooking the Baltic Sea.

His mother, Jenny, was as wild as Ernst August was stable. She had been born in Dutch South Africa, where her father had hurried in search of riches in the mines, just as the “forty-niners” were rushing for gold in America.

After Ivar left Kalmar and graduated from engineering school in Stockholm, his rise was surprisingly fast: he worked construction jobs throughout America and Mexico, formed a construction partnership in London, and then expanded into other industries, including film, real estate, and telecommunications. By the time of the world war, he was a millionaire and an industry leader. When he saw that his family’s match business was struggling, he decided to return home, not just to help his family but also to exploit the enormous opportunity in matches.

He was a pioneer of vertical integration, buying timber tracts and chemical factories to secure the raw materials needed to make matches. Finally, he merged the leading Swedish competitors to form Swedish Match, a single dominant business with initial capital of about $10 million. Ivar owned half of Swedish Match, held all of the senior executive positions, and controlled the company’s board.

In 1922 the industry was highly competitive. Profit margins were narrow. Swedish Match manufactured 20 billion boxes of matches per year, but its profits per box ranged from just a few cents down to a fraction of a penny. Ivar’s plan was to limit competition and increase profits by securing a monopoly on match sales throughout the world, mimicking the nineteenth-century oil, sugar, and steel trusts. Then, Swedish Match could raise prices without losing sales.

Ivar formed Svenska Filmindustri, a company that dominated Swedish cinema and brought him great pleasure, though little money. SF, as the company was known, was at the center of the golden age of Swedish film, and made critically acclaimed movies based on novels by the country’s leading writers.

As a result, there were more day traders per capita during the early 1920s than at any other time in history.

His stories were so popular that Edwin Lefèvre, the author of the articles in the Saturday Evening Post, assembled them into a bestselling book, Reminiscences of a Stock Operator. During the years after the book’s publication, Livermore lost the entire $100 million he had made betting on the markets, and then shot himself with a .32 caliber Colt automatic pistol.

He wowed the passengers on Berengaria with dramatic tales of his various construction projects: from his exploits in Johannesburg while building the Carlton Hotel to his twelve-year odyssey putting up the Stockholm City Hall with nearly 8 million bricks. Architects already were calling Stockholm City Hall the most beautiful building in Scandinavia, and its stunning room, the “Blue Hall,” was soon to house a 10,270-pipe organ and host the Nobel Prize ceremonial dinner.

2 - GETTING TO LEE HIGG

Lee Higginson, or “Lee Higg” as it was popularly known, had been a dominant player in global finance since before the Civil War. John Lee and George Higginson, cousins by marriage, had formed a stock brokerage house on State Street, Boston, in 1848. The partners included three generations of Harvard men, many related by Boston blue blood, and they were wary of outsiders.

Henry Lee Higginson led the firm until his death in 1919. Henry was a prominent philanthropist - he founded the Boston Symphony Orchestra - and his advice about the banking business echoed Pierpont Morgan’s famous testimony to Congress that character came before money or property. According to Henry, “The house has always tried to do its work well and to have and keep a high character. Character is the foundation stone of such a business, and once lost, is not easily regained.”

Just three years earlier, he had set up a corporation in New York called American Kreuger & Toll, which he had hoped would attract American investors. Yet that company had failed - spectacularly so. Ivar’s recent public relations blitz, and his planned performances at sea, were designed to obscure that failure, and to remarket Ivar as someone new to America.

However, Ivar quickly confronted two major obstacles. First, monopolies were illegal in the United States. Unlike a few decades earlier, when industrywide trusts were essentially unregulated, prosecutors were now targeting antitrust violators. Ivar couldn’t simply buy every match factory, as he had in Europe. Second, another company, Diamond Match, already controlled much of the US production of matches. To the extent anyone was likely to achieve Ivar’s plan of an American monopoly, legal or not, it was Diamond Match, not him.

Donald Durant had been something of a playboy in his youth, but even he would have been surprised by the amount of time Ivar was devoting to teenage actresses. Lately, Ivar had become more fixated on Swedish film projects and aspiring female models than on the American match industry.

Throughout their lives, Ivar and Greta would share this bond, as the two most famous people from Sweden during the 1920s. They loved each other, in a way, though neither found the idea of a permanent relationship with another person attractive. Like Ivar, Greta embraced the idea of love, but questioned the notion of marriage. As she put it, “Love? I have said over and over again that I do not know. There is always my overwhelming desire to be alone.” When Ivar and Greta saw each other, there was a deep connection, a kind of shared loneliness. By the time of the Fairbanks-Pickford ball, Ivar’s department store discovery was a new person, with a new name. She was Greta Garbo.

Instead, Ivar would dangle a new idea before Durant: the prospect of Americans investing in foreign monopolies.

Ivar recalled the extraordinary scheme orchestrated during the seventeenth century by Robert Harley, Earl of Oxford, who had formed the South Sea Company to assume England’s national debt. The scheme had become known as the South Sea Bubble, for the sharp increase in the price of South Sea Company shares. In exchange for the South Sea Company assuming its debt, the British government had given the company a monopoly on trade to the South Seas. The deal helped keep England solvent, and led to a boom in the business and share price of the company.

Ivar’s grand idea was to do just what Harley had done, except with matches instead of South Seas trade. Ivar would lend money to the governments of Europe in exchange for a monopoly concession for the production and sale of matches within their territories. It was a brilliant concept.

3 - THE SPEECH

Ivar was about to use the two important oratorical lessons he had absorbed from giving hundreds of speeches to investors in Europe: speak from memory, and use lengthy pauses. First, he rubbed his hands together - a long-standing habit - to show he did not plan to use any notes. Second, he paused. And then he paused some more. And then some more. Ivar had learned the power of silence. He liked to make eye contact with everyone in the audience, one by one, and he did so slowly, before he uttered a word.

Ivar might have said something about traveling to South Africa with Jordahl to build the Carlton Hotel, then the world’s largest commercial building. But he certainly would have left out the part about their gambling on diamond and gold shares in Johannesburg, or how Ivar briefly joined the Transvaal Militia and then went on a multi-year bender through Paris, India, East Africa, Toronto, and throughout the United States.

On May 18, 1908, Ivar and Paul Toll formed Kreuger & Toll in London. The business was small, with shoestring capital of just over 2,500 dollars, but they produced a superior product and had ideal timing. Kreuger & Toll was part of a wave of migration to London after the market panic of October 1907. Pierpont Morgan had single-handedly rescued several Wall Street banks and indebted trusts from bankruptcy, but the ensuing legislation, which led Congress to create the Federal Reserve System, drove lending abroad. Pierpont sent his son Jack to London, to be groomed along with the world’s leading financiers. The Morgans, and other bankers, shifted operations to London.

But Ivar understood a fundamental proposition about the allocation of risk: both parties to a deal can gain when the party in the best position to bear a risk takes on that risk.

Kreuger & Toll became the first firm in Europe to commit to finish projects by a fixed date.

Soon Kreuger & Toll was building major landmarks, including the stadium for the 1912 Stockholm Olympics and the renowned Stockholm City Hall, which many people considered the most beautiful building in Scandinavia.

The hardball tactics Ivar used to take over competitors must have reminded Lee Higg’s partners of John D. Rockefeller, who used a similar approach to acquire competitors of his company Standard Oil. To get the money for these expansions, Ivar turned to Oscar Rydbeck.

Just as Rockefeller controlled oil and Morgan controlled banking, Kreuger envisioned controlling matches, and thereby joining an élite group of global monopolists.

Ivar pressured owners of rival match factories to sell to him or lose any chance at making a profit. He took advantage of wartime conditions by negotiating “sweetheart” deals with the Swedish government, and by selling matches to the Germans, which no one else would do. He took over potash and phosphorus manufacturing and choked off his competitors’ supplies.

During the world war, Ivar crushed Swedish Match’s remaining competitors. He approached factory owners with a simple offer: sell to him or be ruined. Ivar destroyed anyone who refused to sell with ruthless tactics: he took over supply contracts, interfered with customers, and temporarily lowered prices below cost. Almost overnight, he transformed dozens of widely spread and struggling factories into a strong and profitable monopoly. Within a few years, he controlled nearly all of the match industry in Sweden. Swedish Match was one of the few European businesses that remained profitable throughout the war.

He spoke five languages fluently, including near-perfect English.

Two years earlier, in 1920, just a few seconds after the Trinity Church bell tolled noon on a pleasant Thursday in September, a massive shrapnel bomb shook the corner of Wall and Broad Streets in New York. The blast set fire to awnings twelve stories above, sprayed hundreds of slugs into the façade of the Morgan building, and killed thirty employees instantly.

When the bomb hit, Jack Morgan was away vacationing at his Scottish shooting lodge. Jack already had been paranoid, even before this attack on his bank’s headquarters. Just before the war, a mysterious German man had attempted to assassinate him, and he had almost succeeded. Although Jack had recovered from the gunshot wounds, he still suffered from the emotional blow.

He spun elaborate conspiracy theories involving the Bolsheviks and German-Jewish financiers. Jack and his friends were on one side of Wall Street; on the other side were the enemy bankers - Kuhn Loeb, Lehman, and Goldman Sachs - many of whom were Jewish. Jack Morgan neither trusted nor liked Jews. When Harvard president A. Lawrence Lowell sought to fill a board vacancy, Jack, who was an overseer of Harvard and a devoted alumnus, warned that “the nominee should by no means be a Jew... the Jew is always a Jew first and an American second.”

Percy Rockefeller owned the World Match Company of Walkerville, Ontario, and recently had met Ivar while negotiating the sale of a Canadian match manufacturing plant to Swedish Match. The two men had impressed each other, and Ivar saw that Rockefeller, who then served on more than sixty other boards, would be the ideal director of International Match: he was well connected, wealthy, generally familiar with the match industry, and far too busy to care about any details. Ivar had idolized the Rockefellers since he was a boy in Kalmar; now, a member of that family would serve on his board.

Ivar’s popularity helped Lee Higginson sell 15 million dollars of International Match gold debentures, at a price of $94.50 for each $100 of principal amount.

4 - TROUBLE AT HOME

But there was another type of person Ivar felt he could trust even more. By 1922, Ivar secretly had hired a handful of men with no previous connection to him or his companies. These men trusted Ivar for all the wrong reasons: because he had saved them from prison or bribed them or paid them five times what they deserved. Ivar could ask these men to do things he would never ask of friends. Sometimes Ivar needed a person he could trust for reasons more dependable than human love or respect, someone he could rely on as a master relies on a well-trained attack dog. Then, if one of Ivar’s schemes unraveled, he could lay the blame on an out-of-control animal.

Armed with Torsten’s insights about Vaduz, he secretly sent Ernst August to reincorporate Continental Investment Corporation in Liechtenstein. Now, Continental would be doubly hidden - no one could trace a trail from Zürich to Vaduz. The finance minister of Liechtenstein agreed to fix Continental’s taxes at 60,000 Swiss francs for the first two years and 30,000 thereafter, regardless of how much money the company made. The arrangement was perfect. International Match’s earnings would have been subject to tax in America. If Ivar could shift those earnings to Continental he could virtually eliminate any tax.

As the head of International Match, Ivar debited that amount from the company’s cash and replaced it with a credit to Continental Investment Corporation in the same amount. Suddenly, International Match’s primary asset was an IOU from Continental instead of cash. Then, without the Americans seeming to care or even notice, Ivar wired $12,244,792 - all of the remaining proceeds from the International Match gold debenture issue, one of the largest American securities issues in years - to Continental’s account in Vaduz. Ivar was no Charles Ponzi. He wasn’t going to abscond with the money. He just wanted the flexibility to use the funds as he pleased, and to buy time if things didn’t go as planned. In a bad year, he could fudge the numbers and pay dividends out of Continental’s assets. In a good year, he could understate earnings and save for a rainy day by hiding the extra income at Continental.

A large portion of the dividends recently paid by Swedish Match and Kreuger & Toll came from cash raised by International Match in America. In other words, the dividends paid to old investors came from proceeds raised from new ones. That pyramid approach, which had elements of Ponzi’s scheme, couldn’t last forever, and Ivar knew it.

Unlike Charles Ponzi’s postal reply coupon scam, Ivar’s profits were real. Swedish Match made and sold billions of boxes of matches every year.

Ivar and Rydbeck had pioneered an early version of “off balance sheet financing,” loans that a company obtains without showing any debts on its balance sheet. The debts are real, but because they are “off” the balance sheet, the company appears healthier than if it had taken out a straightforward loan.

Swedish Match became one of the first companies to borrow millions of dollars through a complex web of interlocking and related corporations and partnerships without recording those borrowings as liabilities on its balance sheet.

To engineer these deals, Ivar and Rydbeck employed financial derivative instruments known as options, which gave the holder the right to buy shares at a specified time and price. The linchpin of Swedish Match’s option transactions was that they were separated from the company: they were “apart” from Swedish Match and therefore were legally distinct. Specifically, Ivar and the Swedish banks signed a three-year syndicate agreement, and agreed to set “apart” about 60 million kronor for investments. During the first year, Swedish Match would have the right (here was the option) to take over all of the syndicate’s assets for 125 percent of the original amount. From that point on, the banks would have the right (again, an option) to force Ivar to buy the assets for the same amount. Meanwhile, Ivar retained control, as he typically did, and he invested the money on behalf of the syndicate. He also was responsible for bookkeeping. As Ivar reasoned, because the syndicate was legally separate, Swedish Match’s financial statements did not need to show any of the syndicate’s losses or liabilities. Those numbers would not appear on Swedish Match’s income statement or balance sheet.

However, the report was phrased as merely advice; the regulators ultimately did not require that the syndicate disband or take any specific action to reduce its exposure to Ivar and Swedish Match. They accepted self-regulation.

Even if Ivar’s accounting methods had been questionable, the syndicate was making the banks a fortune. And the banks were not only lending money to Ivar; they were his biggest shareholders.

Alwin Ernst ultimately would leave an estate of 12.6 million dollars (although, ironically, Alwin’s estate would lose more than 7 million dollars to taxes and costs due to poor financial planning).

5 - THE GREEN EYE SHADE

Berning was the sort of person Ivar knew he could control. Like the other junior boffins at Ernst & Ernst, Berning saw every new client as an opportunity to advance, to prove to the Ernst brothers that he was partnership material.

During the 1920s, the states, rather than the federal government, played the most active role in securities regulation. Wisconsin was among the most aggressive state regulators.

6 - POLAND FIRST

The early fiscal monopolies included cigarettes, flax, gunpowder, liquor, petrol, playing cards, salt, and tobacco. For many countries, the tax revenues from fiscal monopolies were significant, as much as one-third or more of the overall government budget.

When Ivar received a copy of the signed documents, he did something rather unusual. Apparently, he thought it might be useful to be able to replicate Dr Glowacki’s signature in the future, so he took a signed copy of the contract to a stamp shop and ordered a rubber stamp that would produce a facsimile. Ivar had been skilled at forging signatures as a child, but now he decided he wasn’t good enough. From then on, he would obtain rubber stamps of official signatures for nearly all of his match deals. Dr Glowacki’s stamp was his first.

Ivar devised a more elegant solution to this problem. It was an ingenious piece of financial engineering that would survive the test of time. Ivar decided to introduce a new type of security, which he called a “B Share.” Ivar began with Swedish Match. He divided its common shares into two classes. Each class would have the same claim to dividends and profits, but the B Share would carry only 1/1000 of a vote, compared to one vote for each A Share. It was a simple, but profound, insight. B Shares could be sold to investors without affecting control. Ivar could double the size of his capital, while diluting his control by just a fraction of a percent.

Such non-voting shares also became common during the mid-1920s. The practice spread so widely that Harvard Professor William Z. Ripley dubbed 1924 the “Year of the Vanishing Stockholder.”

Ivar lived at No. 13 Villagatan, in one of Stockholm’s most distinguished neighborhoods, a short walk from Tekniska Högskolan, the engineering school he had attended during the late 1890s.

Ivar showed Lange a balance sheet for Garanta listing millions of dollars of assets and liabilities and abruptly asked him to sign, attesting that the figures were correct. That was it - then he could go. What was Lange to do? He told Ivar he’d like to look over the balance sheet first, as such huge sums were involved. According to one account, Ivar stared at him stone-faced in response, and, when Lange mumbled that it would be nice to know where all the money was going, Ivar said it was being spent secretly in Poland and shouldn’t be mentioned. Ivar told Lange, “If you don’t believe me, go to Poland and see for yourself.” Lange nodded, and signed. Ivar had always treated him well. Why would this time be any different?

After tea or coffee in his apartment, Ivar would take his evening stroll. Walking was his primary form of exercise and he loved it, just as he had as a young man. Sometimes, when Krister Littorin was in town, they would walk together. But more frequently, Ivar would go alone. Every night he spent at Villagatan, Ivar would step out past the Carl Milles sculpture in the courtyard, turn his collar up so he wouldn’t be recognized, and wander the streets and parks of Stockholm for hours.

The money Ivar had spent on the Bernings’ vacation was well worth it. As the details of the new preferred issue were being finalized, Ivar’s auditor - the one man who might have asked penetrating questions about the accounting details of the deal - had been just where Ivar wanted him: strolling the streets of London and Paris with his wife.

In an extraordinary auditor-to-client letter, Berning wrote to Ivar on December 11, that “In view of the fact that the circular stated that the earnings for the first six months ‘were in excess of $4,400,000’, I thought it best to increase this amount slightly.” Increase this amount slightly? Yes, at Berning’s request, Ernst & Ernst reported net income for International Match of $4,475,000, a nice round number that was higher than the income Ivar and Lee Higginson previously had reported to investors.

7 - LE BOOM

From 1923 to 1929, Ivar tripled his funds raised from American investors; he persuaded the New York Stock Exchange to list his securities; he pulled even with Morgan as a leading lender to Europe by securing match monopolies in several countries, including France; he built his 125-room Match Palace in Stockholm; and in general he got really, really rich.

As the story went, at a dinner party she asked him, “Mr Coolidge, I’ve made a bet against a fellow who said it was impossible to get more than two words out of you.” His famous reply was, “You lose.” (Parker got the last word, as she typically did. When told in 1933 that Coolidge had died, she quipped, “How can you tell?”

Coolidge’s famous statement, often misquoted, was that “the chief business of the American people is business.” From 1923 to 1929, he was right.

According to Professor Ripley, the stock price boom couldn’t possibly be based on reality because investors lacked basic information about companies.

The Garanta obligation was International Match’s primary asset, and Berning hadn’t even known it existed.

At the beginning of 1927, Durant asked to send someone to visit Ivar’s match factories in Sweden. Previously, Ivar had refused to permit inspections, citing concerns about confidentiality. Some of Ivar’s obsession with trade secrets seemed justified, but at times his stories seemed far fetched, not unlike the conspiracy theories of Jack Morgan.

In Berlin, Ivar told Berning a secret. He understood Berning’s suspicions, and he confided that, indeed, the financial statements for International Match were in error. There were mistakes. But not for the reasons Berning might have imagined. Instead, the financial statements were wrong because they massively understated Ivar’s profits. Ivar told Berning he was involved in politically sensitive deals with numerous governments, many of which would generate substantial profits, and these dealings simply could not be disclosed to anyone. Ivar said Berning should draw comfort from the safety net of secret deals that were not even mentioned in his corporate accounts.

Moreover, Ivar behaved like someone who understated, not overstated, his income. One time, Ivar sent the money for International Match’s dividends to America early, indicating to Berning that “we have so much money over here, you might as well have this now.” Another time, Ivar sent an extra million dollars, and later responded, “Oh, we simply made a mistake. We have so much money here, we just can’t keep track of it.”

Pierpont Morgan had always been the leading lender to France, and his son Jack had assumed he would inherit any French business. That assumption had been true through 1926. Both Jack Morgan and Ivar had made overtures to the French government during 1924 and 1925, but Jack had won the beauty contest each time. Ivar had made progress in some smaller countries, but the titans of Europe - France, Germany, and Italy - remained wedded to Morgan.

With the rise of the investor class in America, the financial power base was shifting from banks to investors, and this shift was very much to Ivar’s advantage. Previously, banks had played the primary economic and financial roles, and a handful of bankers, led by Morgan, had exercised control of the financial system. But now that investors were becoming more important, the bankers were losing their grip.

Overall, American investors had bought 70 million dollars of International Match’s securities, which made Ivar’s company one of the most widely held stocks in the US.

Even experts in the dismal science of economics were giddy in 1927: world-famous economist John Maynard Keynes pronounced that, “We will not have any more crashes in our time.”

This profit of 2.5 million dollars represented one of the largest fees for any financial transaction in history. Ivar simply played the role of intermediary, putting together American investors who had money with a French government that needed money. The market regarded International Match’s credit risk as substantially better than that of the French government, so International Match could raise 98.5 cents from the market, give 93.5 cents to France, and keep a nickel for itself. So long as the payments matched over time, and the derivative payments did not increase too much, International Match would retain the full amount of the upfront profit. Indeed, if France repaid the loan early, International Match might make even more money.

Ivar explained that the medal he wore was “given to commemorate the Olympic games at Stockholm.” He didn’t cite the fact that he personally had financed the Stockholm games;

8 - THE MATCH PALACE

By late 1927, Ivar held match monopolies in nearly a dozen countries. International Match’s preferred share issues had more than tripled in value since they were floated, from a price of 35 dollars to more than 100 dollars on the Curb Exchange. Ivar still controlled International Match; its common stock was still held by Swedish Match and some Swedish banks. Swedish Match now had 26,000 employees and more than ninety match plants throughout the world, including new factories in Algeria, the Philippines, and throughout South America.

Ivar also had used his highly priced preferred shares as currency to expand beyond the match industry by purchasing other businesses and paying the sellers with securities of his companies instead of cash. Ivar bought banks, mining companies, railways, timber and paper products firms, film distributors, real estate, and even a controlling stake in the Swedish telephone industry, then dominated by L. M. Ericsson & Co. He controlled half of the international market in iron ore and cellulose. He bought mines all over the world, including the Boliden mine in northeast Sweden, which had substantial gold deposits. He bought acres of land in central Berlin, and exclusive buildings in Amsterdam, Oslo, Paris, Stockholm, and Warsaw. Ivar paid taxes on income of over 2 million kronor per year, more than anyone in Stockholm. And, obviously, not all of his income was taxed.

A year after the French deal closed, the Match Palace was complete. The long four-story structure was tucked behind heavy wrought iron gates at 15 Västra Trädgårdsgatan, which translates as “Western Garden Street,” in central Stockholm, just west of the Kungsträdgården park.

Ivar designed it to keep himself safe and secluded. On the fourth floor, at the end of a long corridor, Ivar had built a small private working space that became known as his “Silence Room.” It contained a writing desk and a sofa but was otherwise unfurnished. The room connected to a dressing area, and - most importantly - the door locked from the inside. Ivar would shut himself in the Silence Room for days at a time. It was a special spot where his hidden demons could safely surface. Only Ivar and the janitor had keys.

The middle phone was a dummy, like the third funnel on Berengaria, a non-working phone that Ivar could cause to ring by stepping on a button under the desk. That button was a way to speed the exit of talkative visitors who were staying too long.

When Percy Rockefeller, a director of International Match, visited the Match Palace, Ivar pretended to receive calls from various European government officials, including Mussolini and Stalin. That evening, Ivar threw a lavish party and introduced Rockefeller to numerous “ambassadors” from various countries, who actually were movie extras he had hired for the night. Rockefeller returned from Stockholm with a glowing report,

Like Ivar’s other companies, Kreuger & Toll had continued raising money throughout the 1920s. According to one source, by early 1929 investments in Kreuger & Toll were the most widely distributed securities in the world.

Met Life was satisfied to know it would be able to account for its investment in separate categories, even if those categories didn’t match reality. At the end of 1928, it bought into International Match.

Durant was particularly concerned that Ivar had reported profits for 1928 that were too high, or at least higher than they needed to be. If investors weren’t paying attention to International Match’s numbers, even as cursory as they were, why should Ivar report such high profits?

Ivar was no stranger to mental illness. Both his mother and her father had problems. More recently, Ivar himself had been battling his own bouts of mania and depression while locked in his Silence Room.

Hoover was impressed by the breadth of Ivar’s knowledge of global finance, the history of monopolies, the current American political scene, and even the individual names of flowers in the White House gardens. Hoover was an engineer, too, and had founded the Zinc Corporation before becoming Commerce Secretary. The men had visited the same places, stayed in the same hotels, eaten at the same restaurants. They shared friends. During the following years, Ivar would become one of the President’s most valued advisors.

Academics praised the wisdom of crowds, including the millions of people trading through the New York Stock Exchange. A Princeton economist questioned whether anyone could “veto the judgment of this intelligent multitude?” Yale professor Irving Fisher remarked that “stock prices have reached what looks like a permanently high plateau.”

Ivar’s securities, which now amounted to one-fourth of all foreign corporate issues in the United States.

He also mentioned Ivar’s response to a question about what three things accounted most for his success. The answer, which became emblazoned in the public’s memory, was: “One is silence; the second is more silence; while the third is still more silence.”

9 - A WEEKEND IN GERMANY

The Dawes Plan, for which Charles G. Dawes, Coolidge’s vice president, received the Nobel Peace Prize, was an attempt to ease Germany’s burden.

By summer 1929, Ivar’s outstanding securities already were massive; by comparison, they had a higher market value than the value of the entire loan portfolios of all of Sweden’s banks.

He knew markets reflected emotions and perception. In finance, there was no such thing as reality. There was only, as Pierpont Morgan had intimated, what traders thought of a man’s character.

November 1929 was full of surprises. Just seventeen days after the crash, The Kiss opened in New York. The movie, one of the last silent movies in an era of talkies, was not expected to do well. Yet it was a box office smash. Millions of Americans went to see Greta Garbo’s “silent swan song,” not to mention that kiss.

Everything hinged on the continuing ability of Ivar’s companies to pay high dividends.

Many bankers and investors questioned these numbers. Total world consumption of matches was about 40 billion boxes. Ivar’s factories produced roughly two-thirds of all matches, and the public paid an average price of perhaps one-half cent per box. Basic math suggested that Ivar’s total annual revenue from match sales throughout the world would have been less than 150 million dollars. How much profit could Ivar earn on that revenue? Profit margins on matches, even with a monopoly, were narrow. Raw materials were costly and there also were shipping expenses, taxes, duties, and sales costs. Could Ivar really earn 30 million dollars from revenue of 150 million dollars? That was a wide profit margin of 20 percent. According to one banker who asked Ivar this question, Ivar readily admitted that only about half of his companies’ profits were from the match business. The rest, Ivar said, were from speculation.

10 - ONE LAST CHANCE

He had just received an honorary doctorate from Syracuse University, where he had built the Archbold Stadium.

One barrier to a loan had been Thomas Lamont, Jack Morgan’s partner, who for many years had been doing clandestine work for the fascist regime, in addition to pitching banking deals. An Italian deal would have been particularly galling for J. P. Morgan & Co. Pierpont Morgan had been a major figure in Italy, and the government had honored him in 1904 for finding and returning a cope stolen from the cathedral of Ascoli Piceno.

Within a few years, Ivar had acquired control of Ericsson and put Oscar Rydbeck and other friendly directors on Ericsson’s board.

During the discussions at IT&T, Ivar sat on one side of the table alone, while Sosthenes Behn sat on the other, flanked by a dozen men, including IT&T’s directors and the Morgan partners. Occasionally Ivar would ask a question about IT&T and one of the men from the other side would leave the room for an hour to get an answer. But when someone from IT&T asked a question, Ivar always stayed put and answered from memory. Ivar’s performance during these talks was enormously impressive, and he held forth on a tapestry of topics. According to one source, every night Ivar would stuff his memory with details about some obscure matter, such as Hungarian financial statistics, and the next day he would ensure that the topic came up and then would recite every memorized detail. Someone from IT&T would check the facts, in the hope they could confront Ivar the next day with an exaggeration, but everything Ivar said was correct, to the penny. Later, when Ivar cited precise income figures for one of his companies from memory, it seemed more certain that the men from IT&T were hearing the truth.

During the second half of 1931, Ivar’s securities plummeted in value, so that they were worth only about a fifth as much in December as they had been in June. The decline weighed on Ivar. He complained to Durant that he and his companies “have been the subject of a deceitful press campaign from... some twenty black-mailing papers who continually attack our securities.” Ivar became increasingly paranoid about short sellers, and he personally bought large volumes of his companies’ securities, in an effort to prop up the price.

11 - COMING BACK TO AMERICA

Ivar seriously contemplated suicide during this time. One visitor said he noticed a shotgun in an umbrella stand at Ivar’s Park Avenue apartment.

12 - DEATH IN THE AIR

A full-length feature movie, The Match King, based on Ivar’s life, would be released in a few months.

On the bedside table were three sealed personal notes, addressed in what Littorin said was Ivar’s handwriting. The notes lay next to a copy of the novel The Single Front, by the Russian Jewish writer Ilya Ehrenburg, about an industrialist named Olsson who eerily resembled Ivar. Like Ivar, Olsson owned match factories throughout the world, and was known as “The Match King.” At the end of the novel, Olsson died of a heart attack in a Paris apartment.

Soon, Lee Higg, one of the most prestigious investment banks of the era, would file for bankruptcy and the partners would be ruined, all because they had bet the venerable firm on a self-made man. George Murnane, the senior partner, later told investigators what he thought when he heard the news: “I suddenly knew we had all been idiots.”

One of the officers was surprised by the precision of the single wound, in the exact center of the man’s heart, and estimated that a person attempting suicide would have had only a one in 10,000 chance of such a precise hit. Still, the investigation was brief: no one examined the gun for fingerprints or noticed whether the body had a stunted left index finger. The police never even asked which hand Ivar had favored. They placed Ivar’s note to Krister Littorin under seal, where it would remain for twenty-three years.

Families gathered around their radios to hear John Maynard Keynes, the famous economist, eulogize Kreuger as “perhaps the greatest constructive business intelligence of his age.”

Now, the famed Exchange ticker could not keep pace with the number of trades in shares of Ivar’s companies, even on a delay. When the ticker finally caught up, it recorded the largest single trade in the history of the markets: a sale of 673,800 American Certificates of Kreuger & Toll. By the end of the day, those securities - still among the most widely held in the world - were worth just pennies.

13 - GREATNESS?

King Gustaf cut short a holiday on the French Riviera to be in Stockholm for the funeral. Gustav Vasa chapel was filled with lilies of the valley, one of Ivar’s favorite flowers.

On March 25, less than two weeks after the public learned of Ivar’s death, investigators from Price Waterhouse declared that his companies were insolvent.

Instead, the nails in Ivar’s coffin were the Italian treasury bills. Those forged bills crystallized the public’s view of Ivar in a way that explanations of intermingled accounts, offshore subsidiaries, and off balance sheet liabilities never would.

Millions of investors saw for themselves that Ivar was a crook, just like Charles Ponzi. The only difference between the two men was scale: Ivar had raised fifty times more money and lasted ten times as long.

The investigation of Ivar’s companies spread to the United States, where congressional hearings led many legislators to advocate federal requirements that companies obtain audits and disclose material facts. Ivar’s friend Herbert Hoover had been swept from office, and Franklin D. Roosevelt, the new president, favored dramatic legislative intervention. With a boost from Ivar, securities reform quickly became part of the agenda.

Berning previously had worried that investors would point fingers at him, given his lack of attention to the details of Ivar’s companies. But Ivar was not there to contradict him, so Berning aggressively defended his role. He skillfully navigated the questions, and, this time, his role switched from lackey to champion. Berning could forgive the Times’s spelling when the newspaper labeled him the “Man Who Trapped Kreuger.” The investigators saw Berning as one of their kind, the cat in an international cat-and-mouse chase, the one man who finally uncovered Ivar’s massive fraud, an epic con that left Ivar with no escape.

Members of Congress ignored the inconvenient facts about Berning’s conflicts of interest and duplicity. Instead, they called Berning an exemplar. America needed to give men like Berning a more prominent role.

Both President Roosevelt and Felix Frankfurter, the House of Representatives legal counsel (and later a Supreme Court justice), cited Ivar and Samuel Insull in pressing for new laws. Although legislators referred to Insull’s companies, his schemes were smaller and generated less publicity than Ivar’s; they were geographically limited to the Midwest, and involved neither Wall Street nor New York bankers. Moreover, Insull ultimately was acquitted of alleged financial crimes whereas Ivar would never be acquitted of anything. Insull was an important part of the debate, but Ivar was the man members of Congress had in mind as they thought about who the new securities laws must stop.

But public sentiment ultimately prevailed over industry lobbyists, and the new Securities Act of 1933 became law in May.

The Securities Act required that companies register securities before selling them. Public companies had to disclose material facts, including many matters that companies such as International Match had not disclosed. Congress also included a key provision directed at uniformity of accounting principles. General Accepted Accounting Principles, or GAAP, arose out of this law. A year later, Congress passed the Securities Exchange Act, a related law that created the Securities Exchange Commission and gave American shareholders the right to sue companies for fraud. That right - one of the most important and controversial provisions in American law - also had roots in the public reaction to Ivar’s collapse.

The 1929 crash was not the impetus for the securities laws of 1933 and 1934. Instead, those laws are more accurately described as encapsulating a political reaction to a single bullet and to one man, who was labeled during congressional debates as “the greatest swindler in all history.”

The Committee Report for the Securities Act of 1933 included more than 250 pages on Ivar, and congressional hearing reports also focused on Ivar. Whatever one thought of the 1930s securities laws, it was undeniable that they were a reaction to Ivar.

For most people, Price Waterhouse’s punch line was enough: Ivar’s companies were a “confidence” game, which worked only because Ivar had “autocratic powers,” “unquestioning obedience of officials,” and “complete secrecy.” This triple threat - power, obedience, and secrecy - was lethal, and, in Price Waterhouse’s view, Ivar could not have continued to inspire confidence without them.

Far from being the empty shell some people thought, Ivar’s primary company, Swedish Match, survived the scandal and maintained a substantial share of the global match market. The Wallenbergs, a prominent Swedish family, bought a major stake in the company, and Jacob Wallenberg, Sr, served as Swedish Match’s chairman until 1973.

Today, the company has refocused on tobacco products, including environmentally friendly disposable lighters and matches, and it employs more than 12,000 people in eleven countries. It is once again called Swedish Match.

The Boliden mine paid half a million dollars every month, Swedish Pulp had nearly 5 million acres of forest, Grängesberg was the biggest iron producer in Europe, and Ivar’s real estate subsidiaries held eighty-seven buildings in Stockholm alone.

The Nazis left Ivar’s agreement in place when they came to power, and the German government regularly made loan payments, even during the Second World War.

In fact, investigators found evidence that Ivar had done a deal with the Italian government. It was possible that Ivar actually had secretly loaned Italy money, only to have Mussolini renege after his death. But no one was willing to confront Mussolini about this, and Ivar wasn’t talking.

Of course, the lawyers did much better than the investors. Lawyers for the trustee charged more than 100,000 dollars per year. Most of New York’s leading lawyers, including Samuel Untermyer, who famously had elicited Pierpont Morgan’s remarks about the importance of character during earlier congressional hearings, earned large fees from the disputes about Ivar’s remaining assets.

However, given the rules of the game at the time, it is difficult to say that much of what Ivar did was illegal. That shouldn’t be surprising. Ivar had an acute sense of where the legal boundaries fell, and he observed them carefully.

Few of the people Ivar touched had happy endings. The list of his 15,000-plus creditors ran for 200 pages and included such mainstays as Harvard College and the Chase Securities Corporation.

A 10,000 dollar check from Ivar brought down the Prime Minister of Sweden, Carl Gustav Ekman, the leader who had arranged last-minute financing for Ivar when Krister Littorin first called him about the Italian bills. When investigators discovered Ekman had cashed the check from Ivar, which was made out to “bearer,” the Prime Minister initially denied receiving it. But the next day, facing indisputable evidence that this “bearer” was him, and that witnesses saw him cash the check, Ekman agreed to repay the money and resign.

14 - CODA

More recently, some researchers in Sweden have cited evidence that lends some support for Torsten’s theory that Ivar was murdered, or at least raises serious questions about the evidence pointing to suicide. For example, the French police never found a spent cartridge, or an exit hole. Forensic evidence of the clean entry suggested the wound might have been caused by a sharp object, not a gun. The body was cremated quickly, before the autopsy ordered by the Swedish government and requested by Kreuger’s family could be performed. There even was a report that one doctor who examined the body suggested the man had been murdered. A few researchers also have cited conflicting evidence about what the three key witnesses, Krister Littorin, Karin Bökman, and Jeannette Barrault, found in Ivar’s apartment. They claim the French police ignored a basic fact that echoes a Sherlock Holmes story: Ivar was right-handed.

If the pistol was in Ivar’s left hand in a cramped grip, was the evidence at the scene doctored? Did someone move the gun? It would have been virtually impossible for any right-handed person to shoot himself in the center of the heart with a powerful Browning 9 mm pistol, and then end up holding the gun in a cramped grip in his left hand. This would have been particularly true of a man, like Ivar, whose left index finger was stunted from a childhood accident.

The murder theorists also point to the disappearance of three suitcases the French police found in Ivar’s apartment. Apparently, the police turned the suitcases over to the Swedish Embassy, which sealed all three and left them with Karin Bökman to transport to Stockholm. The suitcases were never seen again. Apparently, an attorney representing Oscar Rydbeck and other bankers broke the seals and took papers from the suitcases, including Ivar’s diaries. According to one view, when these men later discovered that the diaries contained evidence of murder, they burned them. This view remains popular throughout Scandinavia, where The Burned Diaries of Ivar Kreuger is a long-standing art and film project.

One final, highly speculative version of the facts about Ivar is the “escape theory,” the notion that Ivar didn’t die on March 12, 1932, but instead planned an elaborate escape and disappeared, leaving behind a trail of fabricated evidence of nervous breakdown and suicide. Investigators actually pursued this theory for a year.

Still, the theory deserves a mention, if only because Ivar’s spectacular story merits at least the remote possibility of an even more spectacular ending. Certainly Ivar, having constructed Potemkin companies, could imagine a clever getaway. He knew there was no other way out, as he was unable to raise new funds. He had the time and resources to find a lookalike, and then enlist help from someone utterly trustworthy.

Several observers at Ivar’s funeral insisted that the body on display did not resemble him. Or suppose the body Littorin and Bökman “found” at Ivar’s apartment was a dummy. Witnesses said the face in the glass section of the casket appeared to be that of a wax doll. A pallbearer reported that he had never carried a coffin as light as Ivar’s, nor had he ever smelled so much wax at a cremation.

When economist John Kenneth Galbraith reviewed one of the many books on Ivar Kreuger, from 1957, he lamented the absence of source references in that book, and in most of the books that had been written about this remarkable man. He wrote that the “time has come when we must incite readers to violence against all authors - certainly all historians - who do not provide a decent minimum of footnotes.